Offshore Company Registration

Offshore Company Formation has a considerable number of benefits for business owners. It is an opportunity to get rid of a complex taxation system and create conditions for the rapid development of your organization. This process becomes much easier if you use the services of our company. Specialists know the peculiarities of offshore jurisdictions and understand how to complete this process as quickly as possible.

All Offshore Jurisdictions

Barbados

Learn More

Bahamas

Learn More

Anguilla

Learn More

BVI

Learn More

Cayman Islands

Learn More

El Salvador

Learn More

Panama

Learn More

Saint Lucia

Learn More

Seychelles

Learn More

St Vincent & Grenadines

Learn More

Mauritius

Learn More

Marshall

Learn More

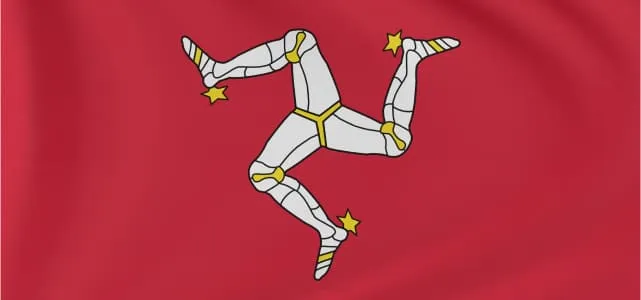

Isle of Man

Learn More

Jersey

Learn MoreReady to Start Your Offshore Journey?

Let our experienced team guide you through the process of establishing your offshore presence with confidence and compliance.

Comparative Table by Offshore Jurisdiction

| Jurisdiction | Registration Time | Tax | Public Company Register | Accounting / Reporting Requirements |

|---|---|---|---|---|

| Panama | ~3–5 business days | 25% local tax; foreign income not taxed (territorial system) | Yes – limited public access | No public filing; bookkeeping required; annual renewal fee |

| Cayman Islands | 2–5 days | 0% corporate tax for international business | No public register of owners | Minimal record-keeping; no audit required |

| British Virgin Islands (BVI) | 1–3 days | 0% on foreign income | No public register of shareholders/directors | Annual Return required (balance + income); no audit |

| Seychelles | 1–2 days | 0% on income earned outside Seychelles | No public register | Accounting records must be kept; no audit |

| Bahamas | 2–4 days | 0% for offshore companies | No public disclosure | Bookkeeping required; no public reporting or audit |

| Saint Lucia | 3–5 days | 0% for IBCs; incentives for international business | No public register | Simplified internal accounting only |

| Anguilla | 2–3 days | 0% on foreign-source income | No public register | Internal records required; no audit |

| Barbados | 1–2 weeks | 5%–15%, depending on activity and structure | Yes – limited disclosure | Annual financial statements and audit required |

| Mauritius | 1–2 weeks | 3%–15%, with exemptions for Global Business Companies | Partial public register | Financial statements and audit required |

| Isle of Man | 3–5 days | 0% standard; exceptions for banking/insurance | Partially public | Annual return, financial statements, and audit (if active) |

| Jersey | 3–5 days | 0% general rate; 10% for regulated sectors | Limited public information | Annual reporting; audit depending on activity |

| Marshall Islands | ~1 week | 0% for non-resident companies | No public disclosure | Bookkeeping required; no annual filing or audit |

| El Salvador | 1–2 weeks | 30% corporate tax; not an offshore jurisdiction | Yes – public register | Full accounting and reporting required |

Why Choose Offshore Company

Support for foreign countries at all levels;

No taxation;

Privacy and protection of assets;

Flexible legislation and ease of registration.

Offshore Company registration involves 4 main stages

Choice of jurisdiction

It is one of the most critical steps. Each country sets its own rules and requirements for the applicant company, so the council will learn more about several jurisdictions at once to make the right decision.

Payment of fees and services of the state registrar

Each country sets its own fixed fee. It does not change depending on the activities of the organization. The total price can be obtained from our specialists.

Opening a bank account and depositing the minimum authorized capital (if necessary).

Each country sets its requirements for the size of the authorized capital. You still need to open a bank account even if it is not required.

Collection of necessary documents.

The passage of each of the stages involves the collection of required documents. All papers must be translated into the language of the country where you want to register.

Required documents for offshore company registration

Name;

Data of founders;

Data of the registered agent;

The legal address of the offshore organization;

Regulations spelled out the goals of the company’s activities and powers.

Amount of authorized capital and currency.

Features of activity and some other things.